Beta values: Risk Calculation for Axfood and Volvo Bottom up beta approach vs. CAPM beta: Ljungström, Divesh: 9783838309743: Amazon.com: Books

Identifying proxies for risk-free assets: Evidence from the zero-beta capital asset pricing model - ScienceDirect

Is estimating the Capital Asset Pricing Model using monthly and short-horizon data a good choice? - ScienceDirect

How can we calculate beta in the stock market, and what is the use of it? - The Intelligent Investor - Quora

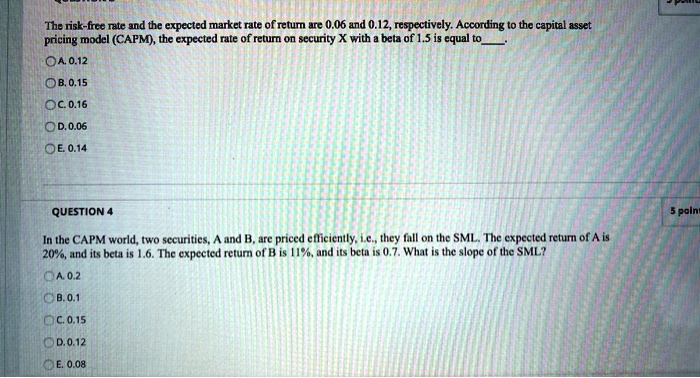

SOLVED: The risk-free rate and the expected market rate of return are 0.06 and 0.12,respectively.According to the capital asset pricing model (CAPM), the expected rate of return on security X with a

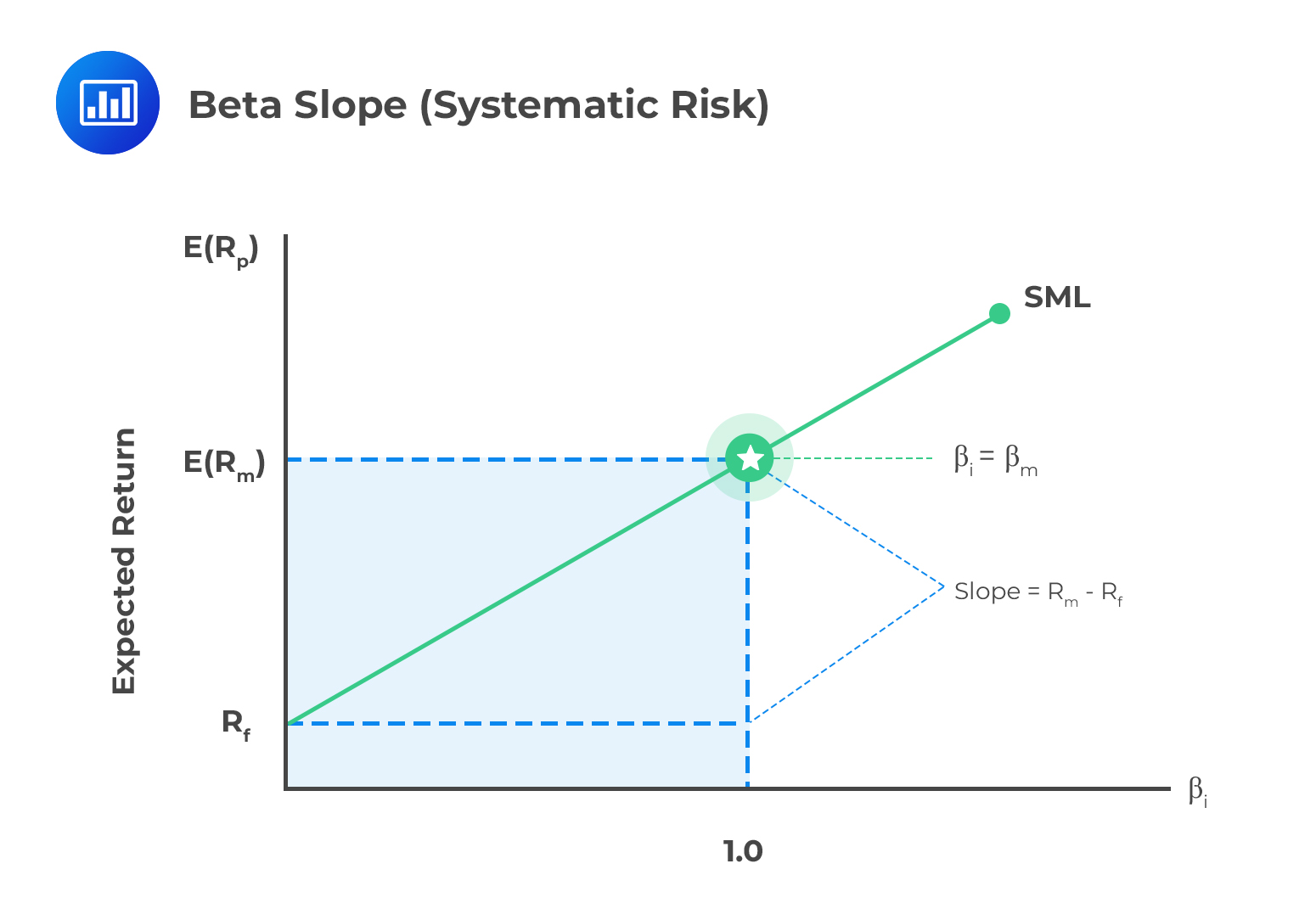

The Capital Asset Pricing Model (CAPM), the Fama-French Model, and the Pastor-Stambaugh Model - CFA, FRM, and Actuarial Exams Study Notes

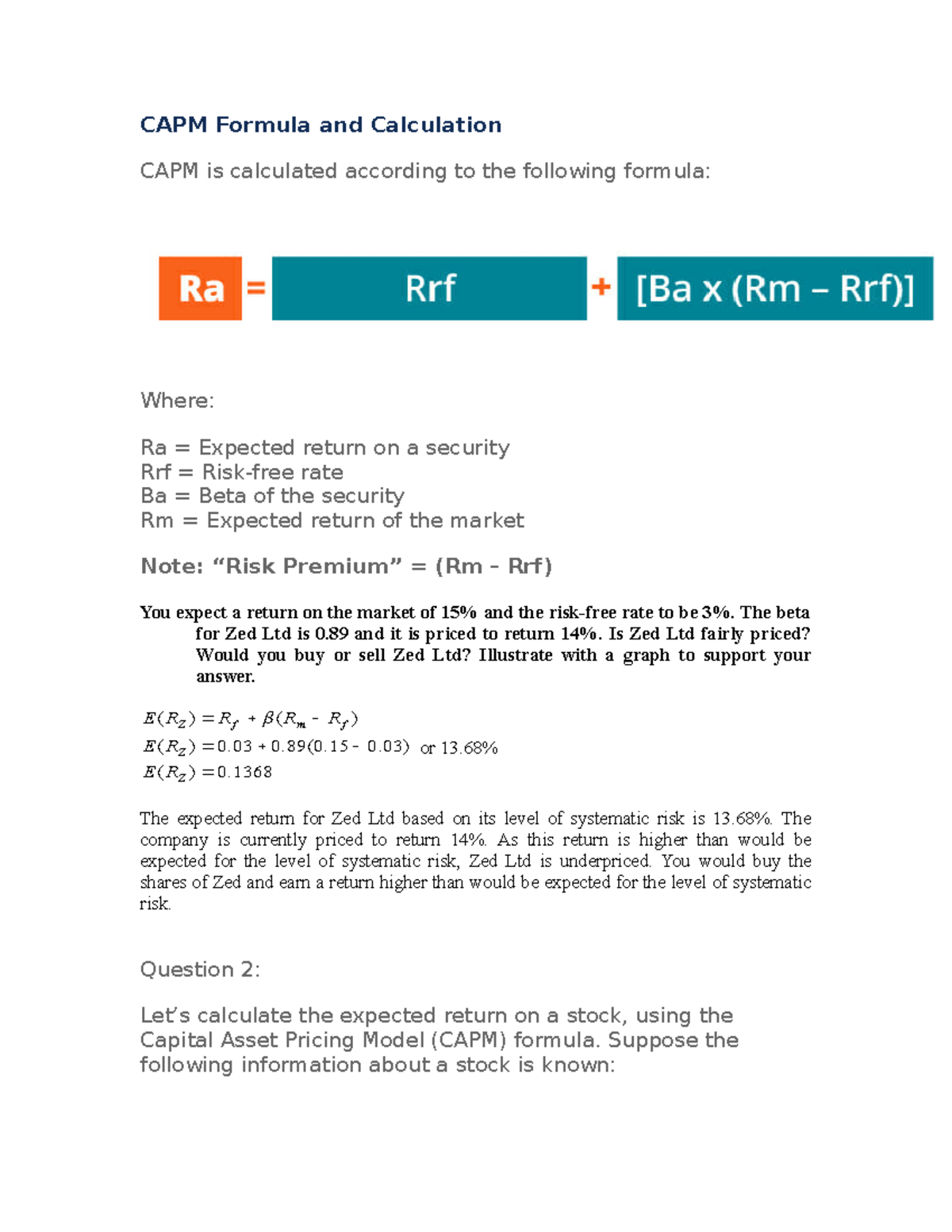

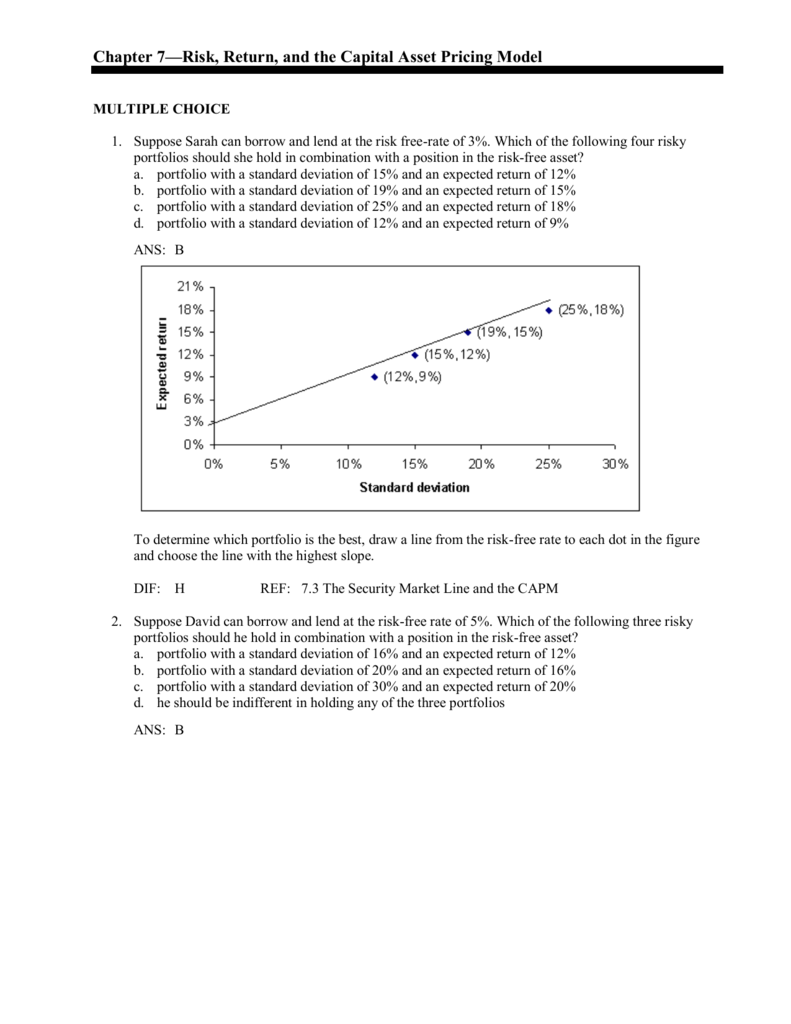

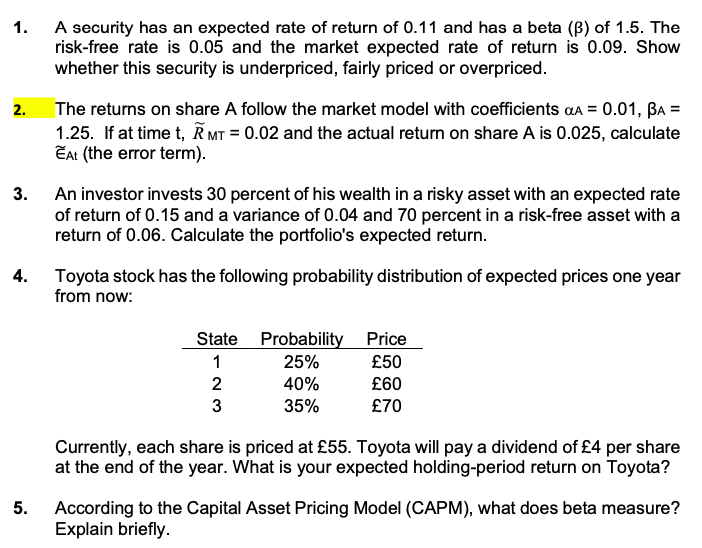

CAPM Formula and Calculation SOlutions - CAPM Formula and Calculation CAPM is calculated according - Studocu

Sustainability | Free Full-Text | Downside Risk-Based Six-Factor Capital Asset Pricing Model (CAPM): A New Paradigm in Asset Pricing

Counts 80 % of total grade The Beta Anomaly and the Conditional CAPM in the Norwegian Stock Market Navn : | Semantic Scholar

![PDF] Test of Higher Moment Capital Asset Pricing Model in Case of Pakistani Equity Market | Semantic Scholar PDF] Test of Higher Moment Capital Asset Pricing Model in Case of Pakistani Equity Market | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/074d12d74e1ebe6203743b691eb69cdeac71acec/13-Table4-1.png)

![MØA 155 PROBLEM SET: CAPM Exercise 1. [2] The expected return MØA 155 PROBLEM SET: CAPM Exercise 1. [2] The expected return](https://s3.studylib.net/store/data/008350621_1-dd322cbb026e3eb4b6f4523f5787c324.png)