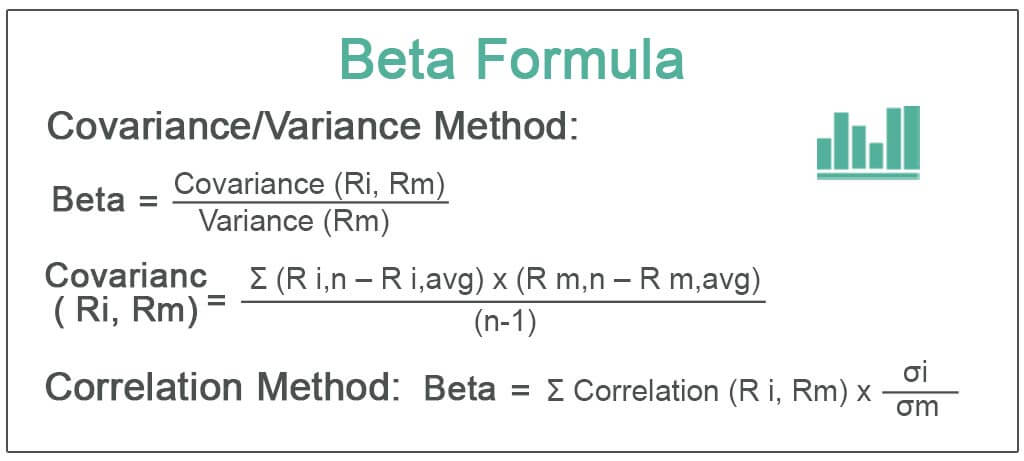

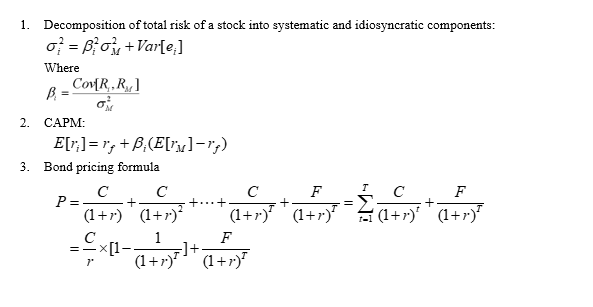

What is Systematic Risk (aka Beta)? How to Calculate Beta of a Stock? - Everything You Need to Know.

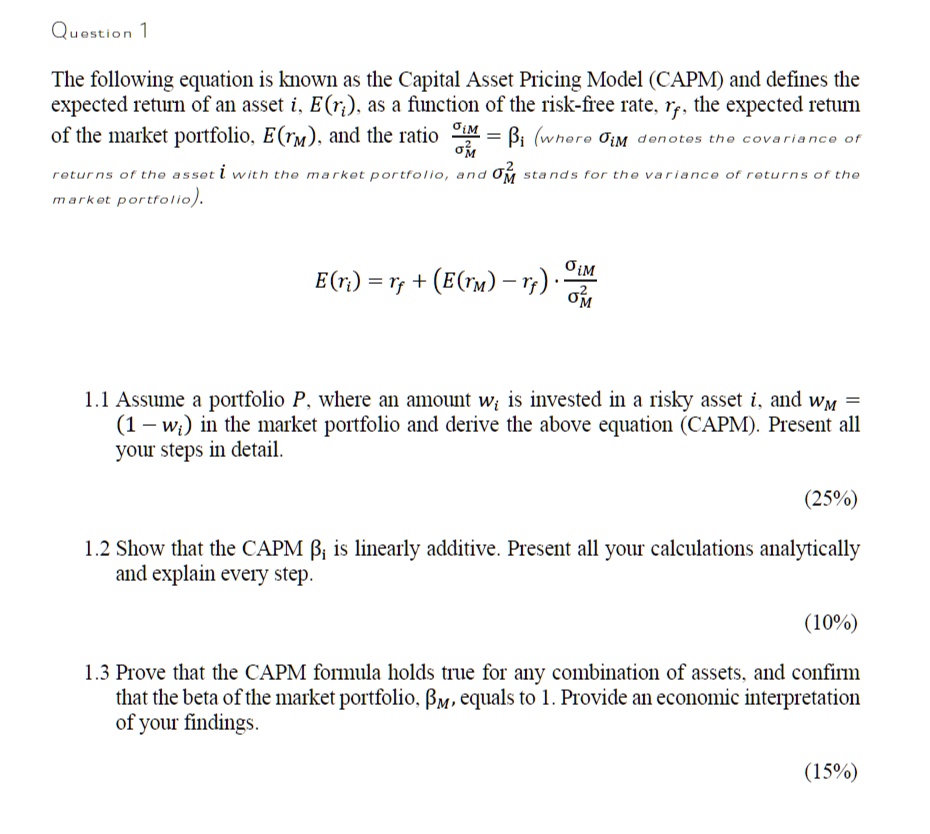

SOLVED: Quostion The following equation is kown as the Capital Asset Pricing Model (CAPM) and defines the expected retu1n of an asset i. E(ra). as a finction of the risk-free rate. rf.

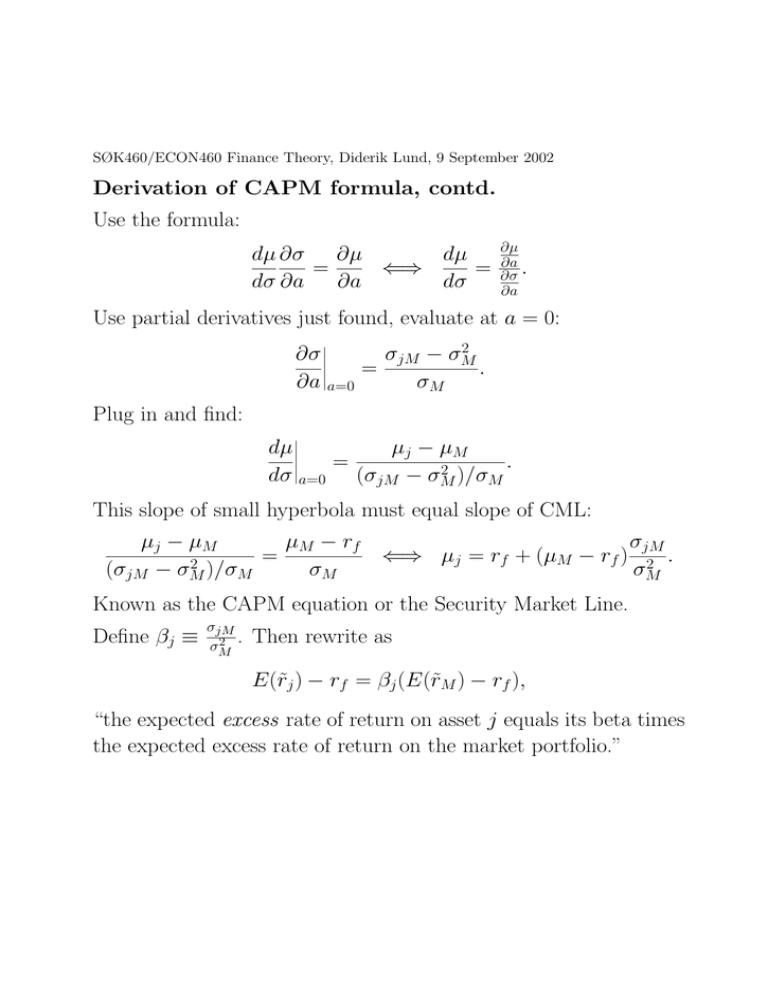

Derivation of CAPM formula, contd. Use the formula: dµ dσ ∂σ ∂a = ∂µ ∂a ⇐⇒ dµ dσ = . Use partial derivatives j

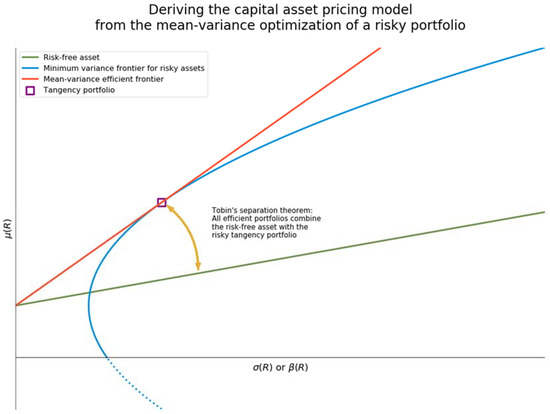

beta - What is the relation between "Capital Market Line" and "Capital Asset Pricing Model (CAPM)"? - Quantitative Finance Stack Exchange